Why Dealerships Should Rethink Passing Credit Card Fees to Customers

It’s tempting: a payment provider promises “no-cost” credit card processing, and it sounds like a no-brainer. But there’s a catch—it’s not free. It’s a surcharge program, and it comes with real risks to your dealership’s bottom line, customer satisfaction, and even your CSI scores.

At PromisePay, we believe in providing solutions that enhance the customer experience—not compromise it. Here’s why surcharging may not be the path forward, and why dealerships across the country are turning to PromisePay instead.

The Hidden Costs of Surcharging

1. Unhappy Customers = Lower CSI Scores

Imagine your customer gets their car serviced and then learns there’s a 3-4% fee just to pay with their credit card. That frustration often turns into negative feedback, poor reviews, and lower CSI scores—something no dealership can afford in today’s competitive market.

2. Lost Trust and Missed Opportunities

When customers feel nickeled-and-dimed, they’re less likely to spend more or return. One bad experience at the checkout can cost you future accessory sales, extended warranties, or referrals. Worse, they may take their business down the road to a dealership that doesn’t surcharge.

3. Legal and Tax Headaches

Many states require sales tax on surcharges—and some restrict or prohibit the practice altogether. If your processor didn’t mention that, what else are they not telling you?

4. Increased Fraud Risk

If customers switch to cash or checks to avoid surcharges, you’re taking on more risk. Checks bounce. Cash has hidden costs. Surcharging can unintentionally push customers toward less secure, more costly payment options.

5. Defecting Customers

Studies show over 50% of customers would consider switching businesses to avoid a surcharge. In today’s digital-first world, the competition is just a click away.

There’s a Better Way: PromisePay

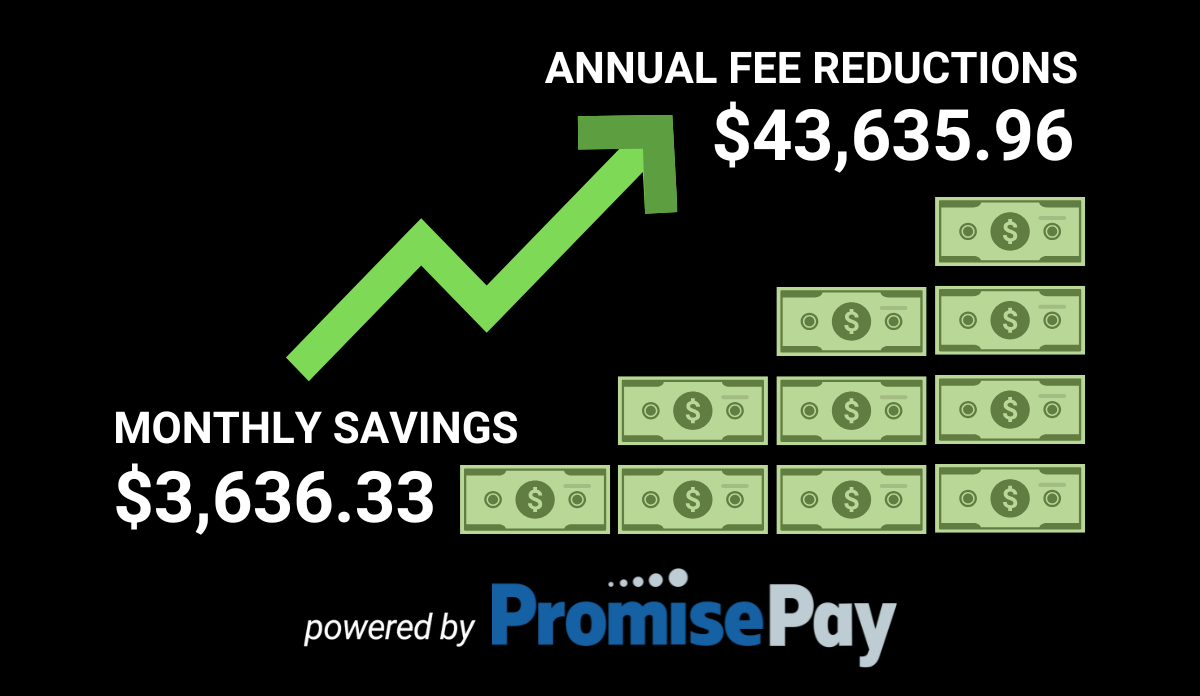

PromisePay helps dealerships reduce processing costs without putting friction between you and your customers. Our intelligent payment solutions give you transparency, control, and customer-first flexibility—without risking your reputation or sales.

We even offer a free statement analysis, so you can see where you’re overspending and what you can save—without passing fees to your customers.

Let’s Talk Before You Surcharge

Before making a move that could impact your CSI and long-term loyalty, get a second opinion. PromisePay can help you uncover cost-saving strategies that don’t alienate your customers.

Let us show you a smarter solution. Click Here to request your free statement analysis from UpdatePromise today.

Stream The Service Lounge by UpdatePromise

YouTube | Apple Podcast | Spotify Podcast

Connect with the Service Lounge

LinkedIn | Facebook | Clubhouse | X/Twitter | About Us

Harmony AI

Harmony AI Intelligent Appointments

Intelligent Appointments Tablet Vehicle Check-In

Tablet Vehicle Check-In Digital MPI

Digital MPI UpdatePromise App

UpdatePromise App AI-Driven Status Updates

AI-Driven Status Updates Dashboard Analytics

Dashboard Analytics AutoRepair-Review.com

AutoRepair-Review.com Full Merchant Services

Full Merchant Services Clover & Payment Devices

Clover & Payment Devices Sunbit

Sunbit SmartPath Service

SmartPath Service MONOGRAM Service

MONOGRAM Service Honda

Honda Acura

Acura Genesis

Genesis Audi

Audi Service Lounge Podcast

Service Lounge Podcast All Features

All Features